If you’re getting ready to buy your first home, your focus is on saving up for everything that purchase involves. One cost that’s likely top of mind is your down payment. But don’t let a common misconception about how much you need to save make the process harder than it could be.

Understand 20% Isn’t Always the Typical Down Payment

Freddie Mac explains:

“. . . nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.”

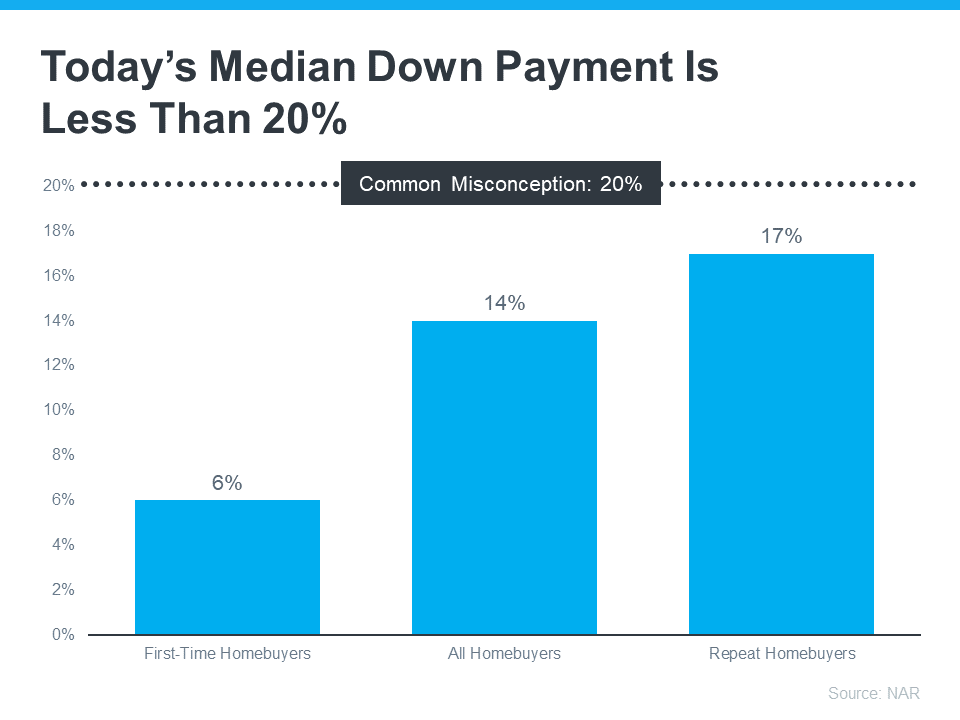

Unless specified by your loan type or lender or coop or condo board, it’s typically not required to put 20% down. This means you could be closer to your homebuying dream than you realize. According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, the median down payment today is only 14%. And it’s even lower for first-time homebuyers at just 6%. However, just maybe not in New York City (see graph below):

Learn About Options That Can Help You Toward Your Goal

If saving for a down payment still feels like a challenge, know that there’s help available. A real estate professional and trusted lender can show you options. That could help you get closer to your down payment goal. According to the latest Homeownership Program Index from Down Payment Resource, there are over 2,000 homebuyer assistance programs in the U.S., and the majority are intended to help with down payments.

Plus there are even loan types, like FHA loans, with down payments as low as 3.5%, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants. Keep in mind, there are specific buildings in New York that are FHA-approved and VA-approved. Additionally, a large percentage of buildings in New York City are not (click the link to review FHA-approved buildings by zip code. To understand your options, be sure to do your homework. If you’re interested in learning more about down payment assistance programs, information is available through sites like Down Payment Resource. Then, partner with a trusted lender to learn what you qualify for on your homebuying journey.

Coops and Condos Building’s Boards

Most New York City co-ops and even condos require buyers to put down 20-25% of the purchase price, about the same as what most lenders require these days. But the range can be vast, depending on the co-op—anywhere from 10% down (rare) to 50% or more at higher-end buildings, as reported by Brick Underground.

Additionally, as outlined in the Brick Undergrounds article “How to Buy An Apartment in NYC” Co-ops will also expect you to have sufficient money left over (also known as the ‘liquid asset’ requirement). Two years’ worth of mortgage and maintenance charges is about average though the amount can range drastically from building to building–from a few months worth of maintenance payments to 1 to 3 times the purchase price of the apartment. In addition, each co-op will expect you to meet a debt-to-income ratio, usually around 25%-29%. That means your total monthly payments–mortgage and maintenance–cannot exceed the specified percentage of your gross income. An excellent credit score is also required.

Add them all up, and you will find that the average co-op’s financial standards are much higher than the average mortgage bank…a primary reason NYC co-ops tend to withstand economic downturns well.

Key Takeaway

Remember, not all situations require a 20% down payment. If you want to purchase a home this year, let’s connect. You’ll also want to make sure you have a trusted lender so you can explore your down payment options.

Additional Blog article to read: “What Is the Average Down Payment for An Apartment In NYC”.