Have you seen headlines about the increase in foreclosures in today’s housing market? If so, they may make you uneasy about what’s ahead. But remember, these clickbait titles don’t always tell the whole story.

If you compare the current numbers with what usually happens in the market, you’ll see there’s no need to worry.

Putting the Headlines into Perspective

The increase the media is calling attention to is misleading. They only compare the most recent numbers to when foreclosures were at historic lows. And that’s making it sound like a bigger deal than it is.

In 2020 and 2021, the moratorium and forbearance program helped millions of homeowners stay home, allowing them to get back on their feet during a challenging period.

When the moratorium ended, there was an expected rise in foreclosures. But just because foreclosures are up doesn’t mean the housing market is in trouble.

Historical Data Shows There Isn’t a Wave of Foreclosures

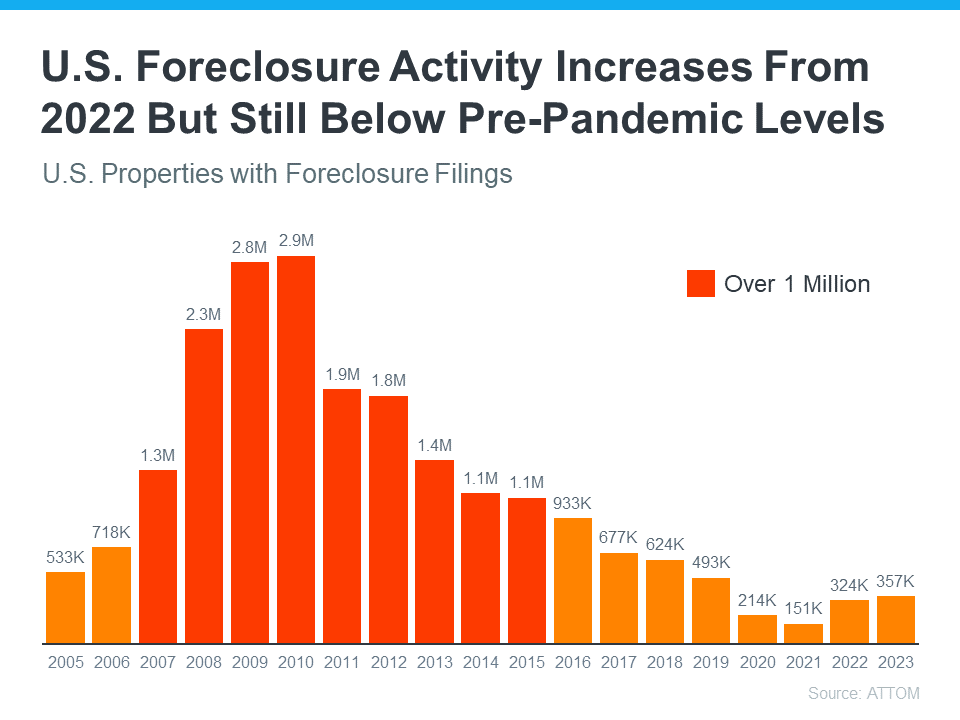

Instead of comparing today’s numbers with the last few abnormal years, it’s better to compare to long-term trends – specifically the housing crash – since that’s what people worry may happen again.

Take a look at the graph below. It uses foreclosure data from ATTOM, a property data provider, to show foreclosure activity has been consistently lower (shown in orange) since the crash in 2008 (shown in red):

So, while foreclosure filings are up in the latest report, it’s clear this is nothing like it was back then.

We’re not even back at the levels we’d see in more normal years, like 2019. As Rick Sharga, Founder and CEO of the CJ Patrick Company, explains:

“Foreclosure activity is still only at about 60% of pre-pandemic levels. . .”

That’s mainly because buyers today are more qualified and less likely to default on their loans. Delinquency rates are still low, and most homeowners have enough equity to prevent foreclosure. As Molly Boesel, Principal Economist at CoreLogic, says:

“U.S. mortgage delinquency rates remained healthy in October, with the overall delinquency rate unchanged from a year earlier and the serious delinquency rate remaining at a historic low… borrowers in later stages of delinquencies are finding alternatives to defaulting on their home loans.”

While increasing, the data shows a foreclosure crisis is not where the market is today or where it’s headed.

Rise of All Cash Buyers

With the rise in mortgage rates, deep-pocketed buyers who may have previously opted to finance the purchase when rates were ultra-low are now paying cash to purchase.

Key Takeaway

Even though the housing market is experiencing an expected rise in foreclosures, it’s nowhere near the crisis levels seen when the housing bubble burst. Let’s connect if you have questions about what you hear or read about the housing market. “The latest REALTORS® Confidence Index report for December revealed an interesting trend in the housing market: a significant increase in all-cash sales, accounting for 29% of all transactions. This rise in all-cash purchases highlights the appeal of having the financial power to make immediate offers and close deals swiftly.” – NAF Cash

Other educational articles about the market and your home search are under Karen’s Blog. Additionally, explore the search bar for other topics of interest.