Homeownership is a significant part of the American Dream. But, the path to achieving this dream can be pretty tricky. While progress has been made to improve fair housing access, households of color face unique challenges in owning a home. Working with the right real estate experts can make all the difference for diverse buyers.

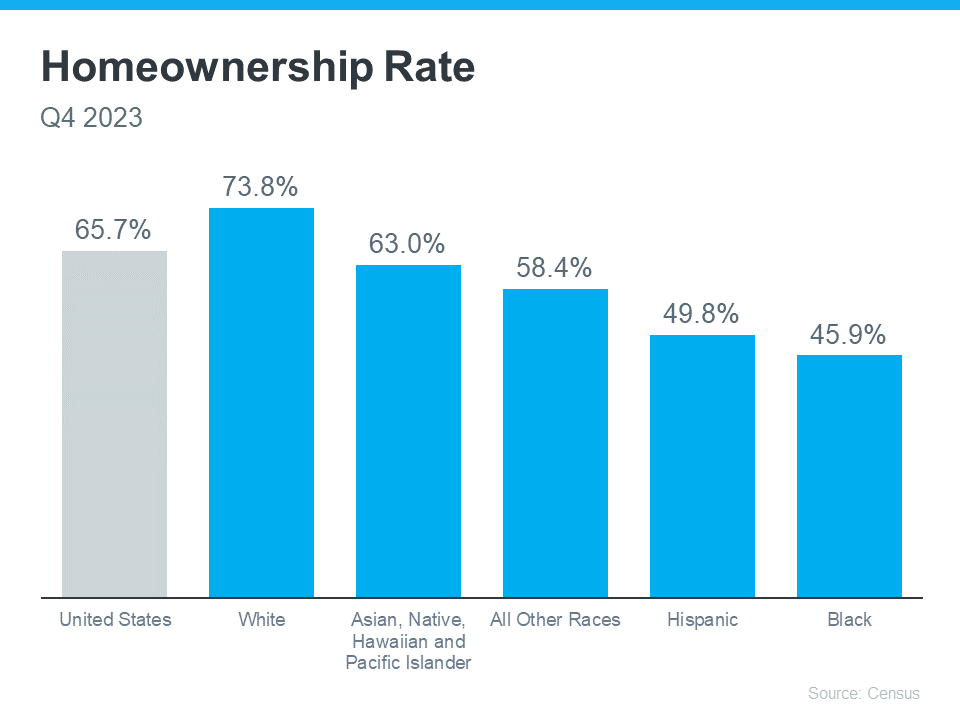

Achieving homeownership is more challenging for certain groups because there’s still a measurable gap between the average U.S. homeownership rate and non-white groups. Today, Black households continue to have the lowest homeownership rate nationally (see graph below):

Homeownership is integral to building household wealth that can be passed down to future generations. According to a National Association of Realtors (NAR) report, almost half of Black homebuyers in 2023 were first-time buyers. That means many didn’t have home equity they could use toward their home purchase.

That financial hurdle alone makes buying a home more challenging, especially when affordability is a primary concern for first-time buyers. Jessica Lautz, Deputy Chief Economist at NAR, says:

“It’s an incredibly difficult market for all home buyers right now, especially first-time home buyers and especially first-time home buyers of color.”

Because of these challenges, there are several down payment assistance programs specifically aimed at helping minority buyers fulfill their homeownership dreams:

- The 3By30 program offers valuable resources for Black buyers, making it easier to secure a down payment and buy a home.

- For Native Americans, Down Payment Resource highlights 42 U.S. homebuyer assistance programs across 14 states that make homeownership more attainable by providing support with down payments and other costs.

- Fannie Mae provides down payment assistance to eligible first-time homebuyers in Latino communities.

Even if you don’t qualify for these programs, many other federal, state, and local options are available. A real estate professional can help you find the best fit for your needs.

For minority homebuyers, the remaining challenges can be a point of pain and frustration. That’s why it’s so important for members of diverse groups to have the right team of experts on their sides throughout the homebuying process. These professionals are advisors who understand the market and give the best advice; they’re also compassionate educators who will advocate for your best interests at every step.

Key Takeaway

Let’s connect to make sure you have the information and support you need as you walk the path to homeownership.

Other educational articles about the market and your home search are under Karen’s Blog. Additionally, explore the search bar for other topics of interest.