You might remember the housing crash in 2008, even if you didn’t own a home. If you’re worried there will be a repeat of what happened back then, there’s good news – the housing market now differs from 2008.

One important reason is there aren’t enough homes for sale. That means there’s an undersupply, not an oversupply like the last time. For the market to crash, there would have to be too many houses for sale, but the data doesn’t show that.

Housing supply comes from three primary sources:

- Homeowners deciding to sell their houses

- Newly built homes

- Distressed properties (foreclosures or short sales)

Here’s a closer look at today’s housing inventory to understand why this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

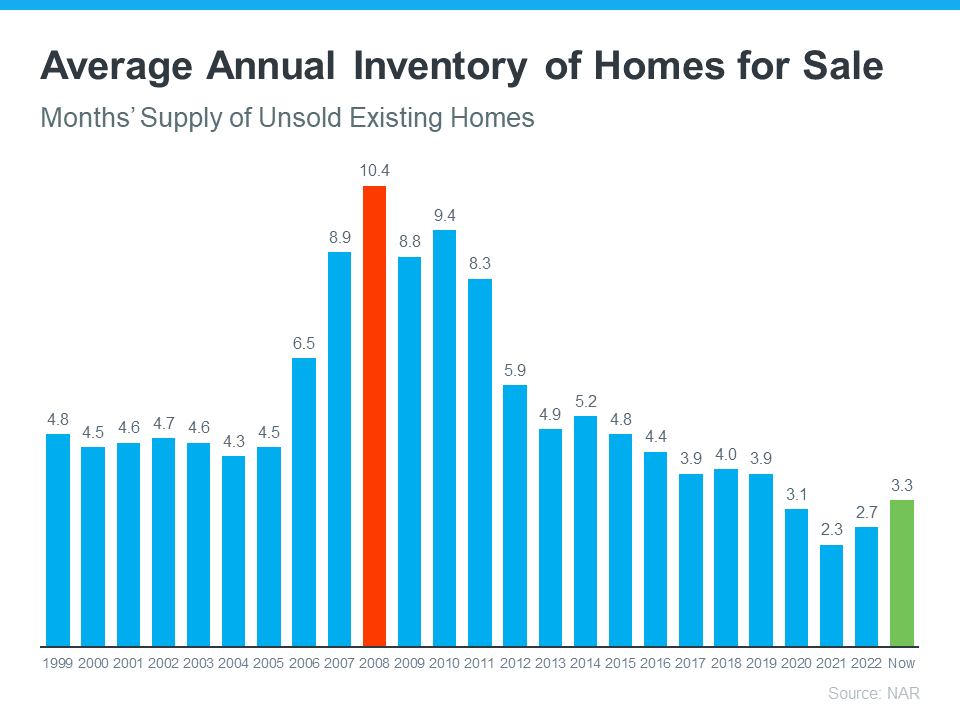

Although the housing supply did grow compared to last year, it’s still low. The current month’s supply is below the norm. The graph below shows this more clearly. If you look at the latest data (shown in green), compared to 2008 (shown in red), there’s only about a third of that inventory today.

So, what does this mean? There aren’t enough homes available to make home values drop. To have a repeat of 2008, there’d need to be many more people selling their houses with very few buyers, and that’s not happening right now.

Newly Built Homes

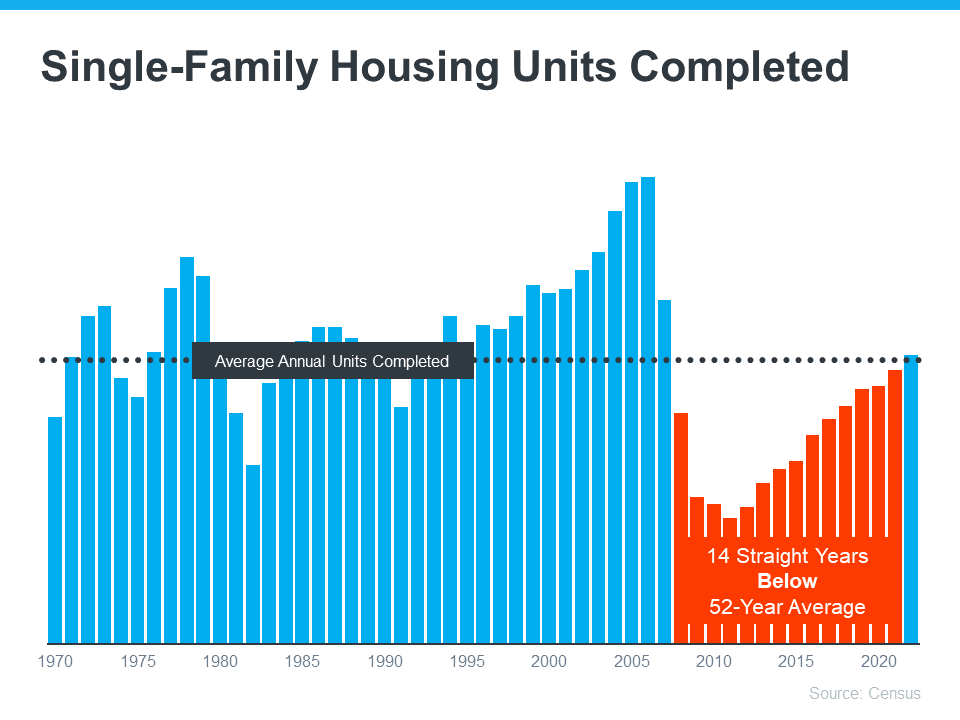

People also talk a lot about what’s happening with newly built houses, which might make you wonder if homebuilders are overdoing it. The graph below shows the number of new homes built over the last 52 years:

The 14 years of underbuilding (shown in red) is a big part of why inventory is so low today. Builders haven’t been building enough homes for years, creating a significant deficit in supply.

While the final blue bar on the graph shows that’s ramping up and is on pace to hit the long-term average again, it won’t suddenly create an oversupply. That’s because there’s too much of a gap to make up. Plus, builders are intentionally not overbuilding homes like they did during the bubble.

Distressed Properties (Foreclosures and Short Sales)

The last place inventory can come from is distressed properties, including short sales and foreclosures. During the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

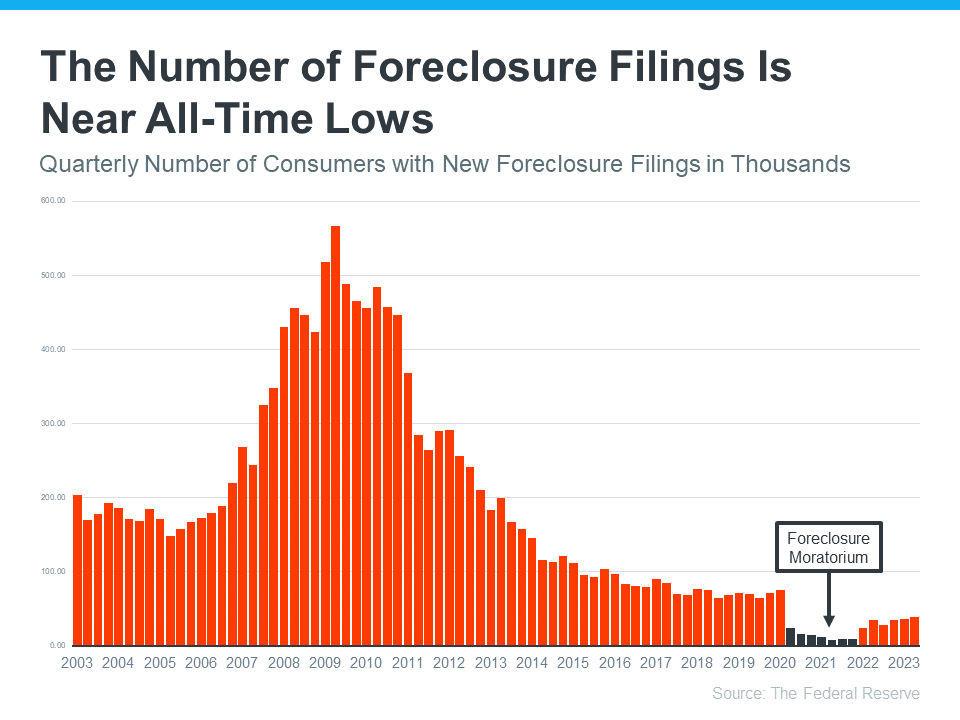

Today, lending standards are much tighter, resulting in more qualified buyers and fewer foreclosures. The graph below uses data from the Federal Reserve to show how things have changed since the housing crisis.

This graph illustrates that the number of foreclosures decreased as lending standards got tighter and buyers were more qualified. In 2020 and 2021, a moratorium on foreclosures and the forbearance program helped prevent a repeat of the wave of foreclosures we saw around 2008.

The forbearance program was a game changer, giving homeowners options for things like loan deferrals and modifications they didn’t have before. Data on the success of that program shows four out of every five homeowners coming out of forbearance are either paid in full or have worked out a repayment plan to avoid foreclosure. These are a few of the biggest reasons there won’t be a wave of foreclosures coming to the market.

What This Means for You

Inventory levels aren’t near where they’d need to be for prices to drop significantly and the housing market to crash. According to Bankrate, that isn’t going to change anytime soon, especially considering buyer demand is still strong:

“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”

Key Takeaway

The market doesn’t have enough homes for a repeat of the 2008 housing crisis – and nothing suggests that will change anytime soon. That’s why housing inventory tells us there’s no crash on the horizon.

Other educational articles about the market and your home search are under Karen’s Blog. Additionally, explore the search bar for other topics of interest.