A Guide to Maintenance Fees in NYC Co-ops and Condos

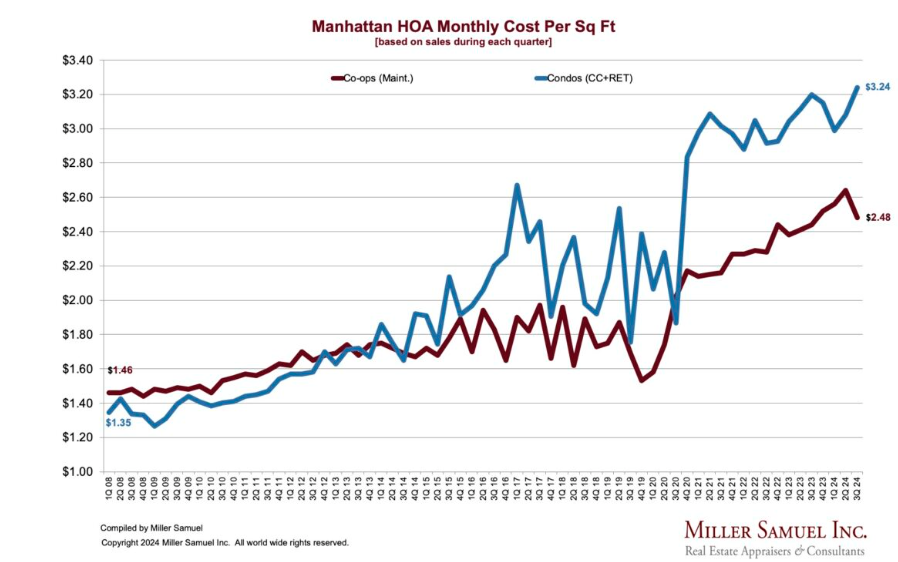

If you’re looking to buy or sell a co-op or condo in New York City, one of the most important financial considerations is understanding maintenance fees (co-op) or common charges (condo). These fees are crucial in determining your overall monthly costs and can vary widely from building to building. The average monthly co-op maintenance in Manhattan is $2.48 per square foot. A 1,000-square-foot apartment would translate to $2,480 a month in maintenance charges. Meanwhile, per Jonathan Miller, condo fees average $3.24 per square foot as of October 2, 2024, based on the sales during the quarter, often reflecting the higher costs of condo ownership and amenities.

As we enter the budget season, these fees are expected to rise. This is driven by several key factors affecting the financial health of NYC buildings, from increased operating costs to declining revenue streams.

Here’s a closer look at how maintenance fees are calculated and why they go up.

How Co-op Maintenance Fees Are Calculated

Each co-op building in NYC operates like a corporation with a set number of shares. The number of shares allocated to each apartment is determined by various factors, such as apartment size, location within the building, and the desirability of its views. The co-op’s total operating costs are divided by the number of shares in the building, and the resulting amount is multiplied by the shares allocated to each apartment. This formula ensures that maintenance fees are proportional to the size and value of each apartment.

The co-op’s operating costs include real estate taxes, payroll for building staff, utilities, and mortgage payments. In many buildings, real estate taxes are the largest expense, followed by staff salaries, utilities, and building insurance. Because these expenses are fixed mainly and non-discretionary, they are passed on to shareholders through monthly maintenance fees.

Some buildings impose regular maintenance charges and special assessments—one-time fees to fund large capital improvements (e.g., new elevators, boiler replacements, etc.). Special assessments are typically added to regular maintenance fees and paid by all shareholders.

Why Maintenance Fees Are Rising

Over the past several years, co-op and condo maintenance fees have increased in New York City. While increases are a nationwide concern, NYC residents have been particularly impacted by the following factors:

- Decreased Revenue Streams: Many buildings in NYC have seen a decline in their revenue streams due to vacant commercial spaces, reduced fees from apartment transactions, and the closure of amenities like gyms and community rooms. As revenue from these sources drops, buildings must make up the difference by increasing maintenance fees.

- Rising Operating Costs: Operating costs, especially insurance premiums and labor costs, have risen significantly. The cost of insuring buildings has increased due to rising natural disaster risks, while wages for building staff—such as doormen, maintenance personnel, and property managers—have also gone up. These cost increases are being passed on to residents through higher maintenance fees.

- Deferred Maintenance: Many NYC buildings, particularly older co-ops, have neglected repairs. As the backlog of necessary maintenance grows, the cost increases (e.g., façade work, boiler upgrades). This increases maintenance charges, especially in buildings with significant deferred maintenance needs.

- Property Taxes: Property taxes are a significant portion of co-op maintenance fees. Increases in property taxes can result in higher maintenance charges, as the building’s shareholders must cover these costs.

- Energy and Utility Costs: Fluctuating energy prices—particularly for heating and electricity—can significantly impact maintenance fees. Many buildings are also investing in energy-efficient upgrades, which, while cost-saving, can temporarily raise expenses.

What Buyers Should Consider

If you’re considering buying a co-op or condo, it’s essential to understand the current and potential future impact of maintenance fees. Rising fees can significantly affect your monthly housing costs, so here are some key points to consider:

- Review Financials: Before committing to a purchase, carefully review the building’s financials, including its operating budget, reserve fund, and history of fee increases. A building with low reserves or a history of sudden fee hikes may not be the best investment if you’re concerned about ongoing costs.

- Ask About Future Assessments: In addition to regular maintenance fees, ask the building management or board if any upcoming capital projects or repairs could lead to special assessments. Understanding the cost and expected duration of a large-scale project is essential.

- Understand the Share Allocation: Since co-op fees are tied to your share allocation, it’s essential to understand how many shares are allocated to your unit and whether that allocation aligns with the apartment’s size and value. Misallocations can lead to higher-than-expected maintenance costs.

- Consult a Real Estate Professional: A skilled broker or real estate professional can help you navigate a building’s financial complexities and offer advice on the long-term viability of the co-op or condo.

What Sellers Should Know

As a seller, it’s important to be transparent about the building’s maintenance fees and any potential increases that could affect buyers. Here’s what you can do:

- Disclose Fee Increases: If your building is increasing maintenance fees or imposing a special assessment, disclose this to potential buyers upfront. Transparency will build trust and help avoid any surprises during the negotiation process.

- Address Concerns: If your building has a history of high or increasing maintenance fees, proactively address any concerns from buyers. Explain the reasons behind fee increases and provide context about the building’s financial stability and plans to manage costs.

- Prepare for Negotiations: Buyers will likely negotiate based on the fees. Sometimes, buyers might offer a lower price if they feel the maintenance fees are too high or anticipate further increases.

Flip Taxes: Another Factor to Consider

Many co-ops also impose a flip tax, a one-time fee paid when an apartment is sold. This is typically a percentage of the sale price paid to the building’s operating reserve fund. The flip tax is not a tax and is not deductible as a property tax. In most cases, the seller pays the flip tax, though some buildings require the buyer to cover it.

Flip taxes vary widely from building to building, so inquire about them during purchase.

Condo vs. Co-op Maintenance Costs: A Quick Comparison

| Building Type | Average Fee per Sq. Ft. | Example for 1,000 Sq. Ft. |

|---|---|---|

| Co-op | $2.48 | $2,480/month |

| Condo | $3.24 | $3,240/month |

| Manhattan Co-op Average | $2.27 | $2,270/month |

Note: These fees are averages and can vary significantly based on the building’s location, amenities, and operating costs.

Looking Ahead: What Buyers and Sellers Should Expect

As we move further into 2024 and beyond. Rising maintenance fees will continue to challenge co-op and condo owners in NYC. Whether you’re buying or selling, it’s essential to understand the financial implications of these increases and plan accordingly. By reviewing building financials, comparing fees, and staying informed about upcoming assessments or capital improvements, you can make an informed decision about your next property investment.

Please get in touch with me if you need guidance on navigating the complexities of NYC co-ops, condos, and rising maintenance fees. I am a trusted real estate professional who can help you make the best decision for your needs.

#NYCRealEstate #HOAFeeIncreases #CoOpLiving #CondoLife #SpecialAssessments #RealEstateMarketTrends #PropertyManagement #RealEstateAdvice #HomeBuyersGuide #NewYorkRealEstate