Goodbye, 2022! Hello, 2023! Manhattan Market Report for the week ending December 30th, Supply closes out down at 5,751. Supply is ending where it began at the beginning of the year. Pending Sales at 2,401 are also down, and off-market listings (delisting) maintain the market pulse at a .40% level. Manhattan is holding on to price action due to the resilient rental market.

2022 has been a wild ride. We’ve never been in a year where the interest rate, the average 30-year fixed, has doubled in one year. It’s been the fastest rise in mortgage rates since they started tracking them over 50 years ago. Some real estate economists are projecting that mortgage rates will begin to fall sometime in 2023, perhaps by the year’s second half. Lawrence Yun, the chief economist for the National Association of Realtors, thinks mortgage rates peaked in November and will hover around 6 percent, or edge lower, in 2023. “That could open the gates for buyers priced out to re-enter the market,” he said.

Manhattan Market Report for the week ending December 30th, Supply closes out down at 5,751. Supply is ending where it began at the beginning of the year. There are signs of inflation starting to cool, and where the market goes from here depends on the Fed’s ability to reign in inflation. And if inflation continues to fall, mortgage rates will likely too.

According to economists, analysts, and real estate brokers, the housing market may be slow in the year ahead, with home prices, rents, inventory, and interest rates not moving much.

Freddie Mac Rates

The 30 – Year Fixed-Rate Move Higher. The housing market remains in the doldrums with declining sales, inventory, and prices. The declines in sales and deceleration in home prices began swiftly earlier in 2022 but have moderated more recently. While the intensity of weakness is moderating, the market continues to decline, and forward leading indicators suggest housing will remain weak throughout the winter.

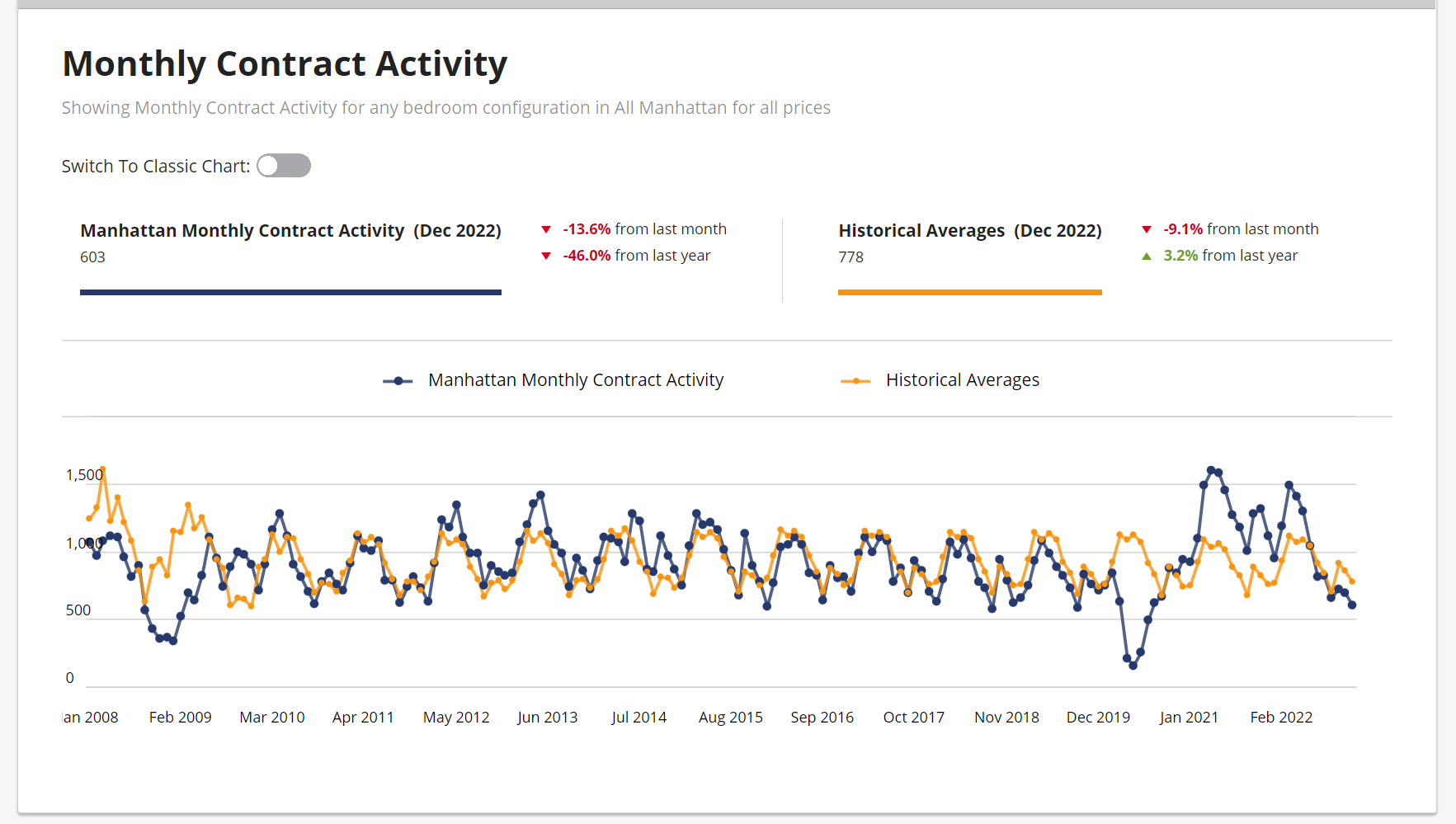

Manhattan Monthly Contract Activity

Monthly Contract Activity resides at 778 (blue bar) trends below the historical averages (gold bar) and are in a range-bound market path. This path is classified as horizontal, ranging, or sideways bound between a high and low range. The monthly Contract Activity range depends on “rate volatility, the Fed, risk assets, credit spread, and other macro indicators.”

Luxury Market

Olshan Report for the last week of 2022 (December 26 – January 1st) reports 13 contracts were signed last week at $4 million and above in Manhattan Market. There were seven condos, five coops, and one townhouse under contract.

The last time New Year’s Day landed on Sunday was in 2017. When the week’s total was 15 contracts. The 10-year average of contracts signed in the last week in December is 14.

Total Weekly Asking Price Sale Volume: $86,114,000 | Average Asking Price: $6,624,154 | Median Asking Price: $5,990,000 | Average Discount from Original Ask to Last Asking Price: 4% | Average Days on Market: 357

Top three Listing

- No. 1 | 812 Park, Unit 5/6D | Asking: $11,500,000 million

- No. 2 | 235 West 71st Street, 5th Floor | Asking: $8,999,000 million

- No. 3 | 820 Fifth Avenue, Unit 2S | Asking: $8,500,000 million

Market Proof Luxury Segment Overview

Key Takeaways

- After a record-setting 2021, demand declined mid-year, but PPSF remained stable throughout the year.

- Aman New York Residences struck the largest deal of the year at nearly $76M

- Manhattan’s The Solaire inked the most significant number of contracts, 84, while Brooklyn’s H7 Condominium sold 92% of its units.

- Brooklyn and Queens chipped away at Manhattan’s new development market share dominance.

- New development inventory sits at roughly 12.7K units at year’s end, representing a $35B+ market opportunity.

2022 New Development

New development activity rose 20% in 2022 compared to the pre-pandemic 2015-2019 average. Sponsors reported 3,278 contracts, representing aggregate sales of $8.3B at projects across the city, up from the $7.1B average.

The median asking price was $1.6M (+6%) and $1,696 PSF (+12%).

Manhattan reported 1,701 deals (+15%), Brooklyn had 1,213 (+20%), and Queens had 364 (+51%).

Though 2022’s numbers appear strong, this is because the first six months of 2022 continued the unsustainable strength seen in 2021, with nearly two-thirds of the year’s activity occurring in the year’s first half.

The new development inventory sits at roughly 12.7K units, representing a $35B+ market opportunity and nearly five years of inventory.

Luxury Segment $4M and Above

The luxury segment, which deals at $4M and above, echoed the increased demand in the broader market in 2022 compared to 2015-2019. Signed contracts were up 17%, from 432 to 507. Aggregate contract volume increased from $3.6B to $4.0B, a gain of 10%.

Although demand increased, the median luxury contract price dipped by 6% to $6.0M, and the median PPSF increased modestly to $2,690.

Like its total market counterpart, luxury in 2022 can be described by the dichotomy between the first and second halves of the year. Demand was well north of the pre-pandemic average during the first six months but slipped below that average during the second six months.

Manhattan Market

Compared to the pre-pandemic 2015-2019 average, demand for new development products increased in 2022. The number of signed contracts rose 15% from 1,484 to 1,701, with aggregate volume increasing 11% from $5.5B to $6.1B.

Median figures for the last asking price and last asking PPSF for contracted units increased, the former by 2% to $2,410,945 and the latter by 6% to $2,096. With a more significant number of new dev offerings in Brooklyn and Queens at lower prices, Manhattan conceded some market share to the other boroughs.