Manhattan Market Report for the week ending March 17th, 2023, Supply closed out at 6,465 and trended upward. Pending Sales at 2,475 and off-market listings (delisting) maintain the market pulse at a .38% level. The market’s liquidity is trending upward.

All-Cash Dominating NYC

“The top 40 percent of earners are sitting on more than a trillion dollars in extra savings amassed during the early part of the pandemic, per a New York Times article“. According to Redfin, almost a third of U.S. homebuyers purchase with cash rather than financing with a mortgage. Buying real estate with all cash is a trend in big cities, and the NYC metro is no different. According to the report, the level of homes purchased with all-cash has not been seen since 2014. The states depending on NYC local, 31% to 50% of home sales were loan free. Buyers purchasing in NYC are equity and cash rich. The trend is affluent buyers are buying with “cash” since mortgage rates have doubled from a year ago. These buyers have built significant wealth and are avoiding high-interest payments that increase their monthly outlay.

The Report

Additionally, “With affluent individuals from overseas stepping back into the game to purchase their dream property, the Coldwell Banker Global Luxury program fielded a new survey to explore the trends and attitudes of the wealthy international consumer. Polling more than 1,200 high-net-worth consumers from 12 countries on their dreams and sentiments of buying U.S. real estate, paired with our annual luxury real estate outlook.”

Furthermore, “The number of global millionaires is at its highest point in history. By 2026, it is estimated that the number of millionaires worldwide will surge by 40%, and one in seven adults will have a net worth of at least $1 million”; “The Report.”

Mortgage Rates

On Thursday, March 23, 2023, the national average 30-year fixed mortgage APR is 6.87%. The average 15-year fixed mortgage APR is 6.13%, according to Bankrate’s latest survey of the nation’s largest mortgage lenders.

Mortgage rates are down following an increase of more than half a percent over five consecutive weeks. Turbulence in the financial markets puts significant downward pressure on rates, which should benefit borrowers in the short term. Homebuyers would greatly benefit from shopping for additional rate quotes during high mortgage rate volatility. Our research concludes that homebuyers can potentially save $600 to $1,200 annually by taking the time to shop among multiple lenders. – Freddie Mac.

On Monday, March 20, 2023, the current average interest rate for a 30-year fixed mortgage is 6.97%, down five basis points over the last seven days. If you’re in the market for a mortgage or refinance, the current average 30-year fixed refinance interest rate is 7.03%, decreasing two basis points over the last week. Meanwhile, today’s current average 15-year fixed refinance interest rate is 6.21%, down ten basis points in the previous seven days. Whether buying or refinancing, Bankrate often has well below the national average, displaying the interest rate, APR (rate plus costs), and estimated monthly payment to help you compare deals and fund your home for less. With interest rates rising, shopping around for mortgage offers is more important than ever before committing to a loan. – Bank Rate

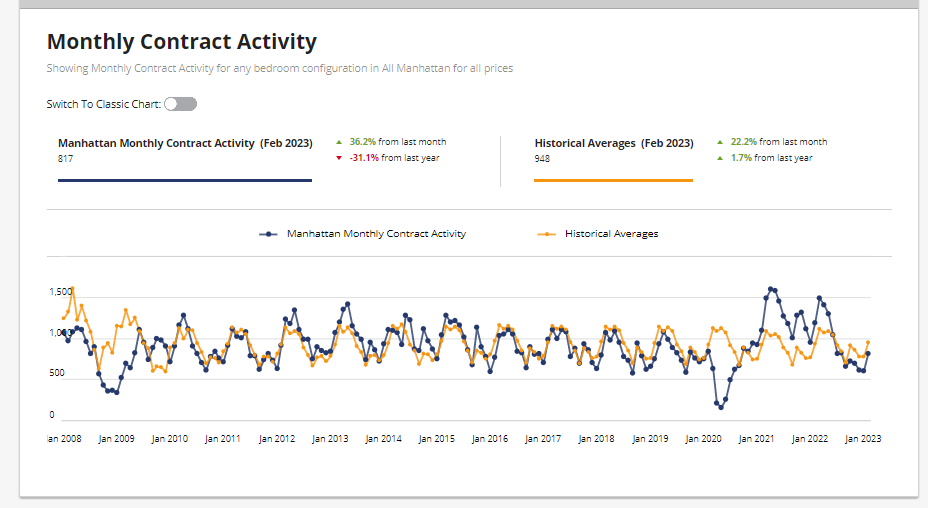

Monthly Contract Activity

Monthly Contract Activity resides at 817 (blue bar). Slightly below the historical average of 948 (gold bar) and is in a range-bound market path. Contracts Signed activity has picked up and is visible in the graph below, showing the blue bar spiking upward.

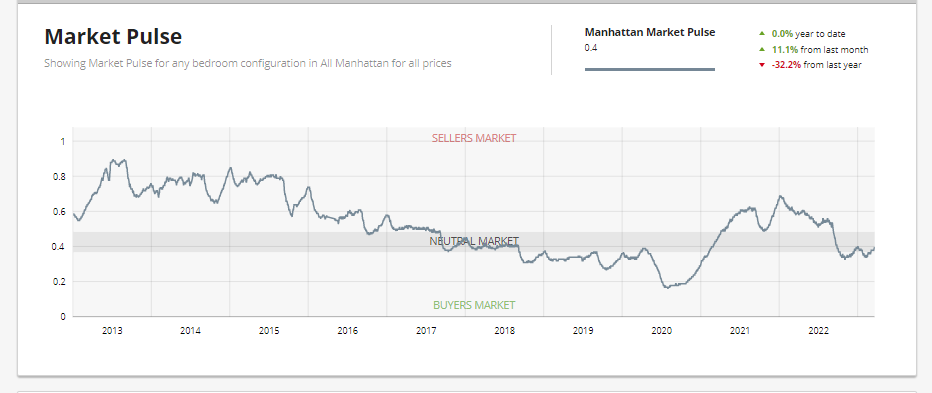

Market Pulse

The market pulse measures the ratio of supply and demand seems to continue to evidence the beginning of the buy-side leverage peaking. The market pulse is residing in Neutral Territory – .4%. The weekly supply has spiked upward and resides at “424”. The weekly contract signed has risen and resides at “250”. Off Market is lower than recently and stands at 124 listings. We are out of the low liquidity zone and shifting to the neutral zone as we enter the busy spring season. There are micro markets in Manhattan in the Seller Zone. NOTE this is not price volume. This is deal volume showing that sellers are receiving bids.

Luxury Market

“We’ve been saying the market is strong, and this week is proof. The new development wasn’t spooked in the slightest by all the banking drama, recording the most significant demand since the week of May 9th, 2022. Eighty-three contracts were signed this week compared to 68 last week and a pre-pandemic 2015-2019 average* of 53. “

– Kael Goodman, co-founder and CEO

Tangible Assets are “Trendy” and are a “Hedge Against Inflation

“Twenty-eight “28” contracts signed for listings asking $4 million and up for the week of March 13-19, 2023 – a drop of 8 from the previous week but still twice the weekly average we were seeing last Fall 2022. A townhouse took the townhouse/brownstone was the top contract signed. Last year, townhouses accounted for the No. 1 deal ten times. – Per Olshan Report

Condos 21 | Coops 5 | Townhouse 2

Top 3 Contracts Signed

- Number 1: 138 East 65th Street | Townhouse | Asking $16.995 million

- 53 West 53rd Street, Unit 48A | Asking $15.25 million

- 15 East 30th Street, Unit 57A | Asking $13,730 million

Despite Bank Failures, New Dev’s Momentum Builds

“Despite the bank bailouts and fear of a trickle-down effect on NYC residential real estate, the new development market strengthened this week. Demand – as measured by the number of contracts signed – increased 22% week-over-week to 83, 55% more than the pre-pandemic 2015-2019 average of 53 contracts. All other metrics were also higher: average price grew by 5% to $2.33M, and average PPSF increased by 4% to $1,785. Total dollar volume inflated 29% to $193M, its highest level since June 2022.

Demand for $4M+ luxury residences for the third consecutive week was more robust than its pre-pandemic average, with 12 contracts signed versus 8.

Of the 83 contracts this week, 47 (+31%) were signed in Manhattan, 32 (+14%) were signed in Brooklyn, and four again signed for Queens properties. This is the widest margin between Manhattan and Brooklyn contract volume in months.” — Market Proof

Sponsor Sales

Manhattan Reports 47 Sponsor Contracts Totaling $149M

The city had a big week because Manhattan’s numbers were gangbusters. Week-over-week, the average price grew 14% to $3.17M, and the average PPSF increased 5% to $2,185. Contract volume, 47, reached its highest level since May 2022, and total dollar volume, $149M, recorded the highest number since September 2022.