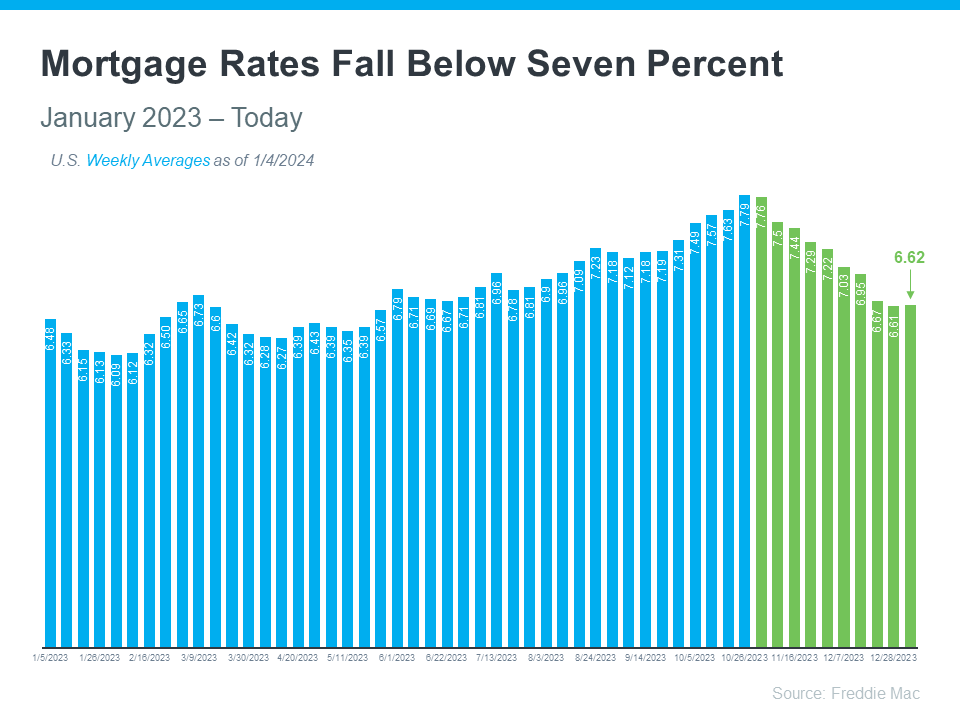

If you want to buy a home, knowing how mortgage rates impact what you can afford and how much you’ll pay each month is important. Fortunately, rates for 30-year fixed mortgages have come down significantly since the end of October and are currently under 7%, according to Freddie Mac (see graph below):

This recent trend is great news for buyers. As a recent article from Bankrate says:

“The rate cool-off somewhat eases the housing affordability squeeze.”

According to Edward Seiler, AVP of Housing Economics and Executive Director of the Research Institute for Housing America at the Mortgage Bankers Association (MBA):

“MBA expects that affordability conditions will continue to improve as mortgage rates decline . . .”

Here’s more context on how this could help with your plans to buy a home.

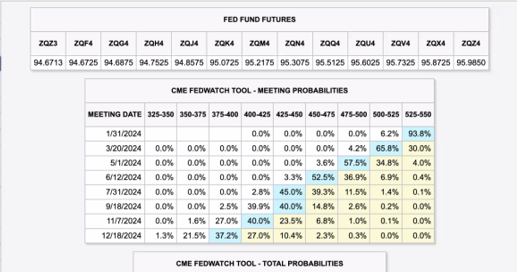

Federal Reserve Dot Plot

The dot plot will show Fed policymakers’ estimates for interest rates at the end of the next several years and over the longer run. The forecasts are represented by dots arranged along a vertical scale — one dot for each Federal Open Market Committee member.

“Jill Fopiano, CFA, CPA, and the president and CEO of O’Brien Wealth Partners, also says that rates will drop. “Following a historically strong rate increase in a short period. The Fed now indicates that it foresees three rate cuts in 2024. This brings the Fed funds rate from its current mid-5% level to 4.6% by the end of 2024,” she says.

She adds that market expectations are more aggressive, predicting six cuts and a Fed funds rate of approximately 3.6% this year.” The first-rate cut will most likely be in March, as the chart below shows a 65.8% probability in the chart below.

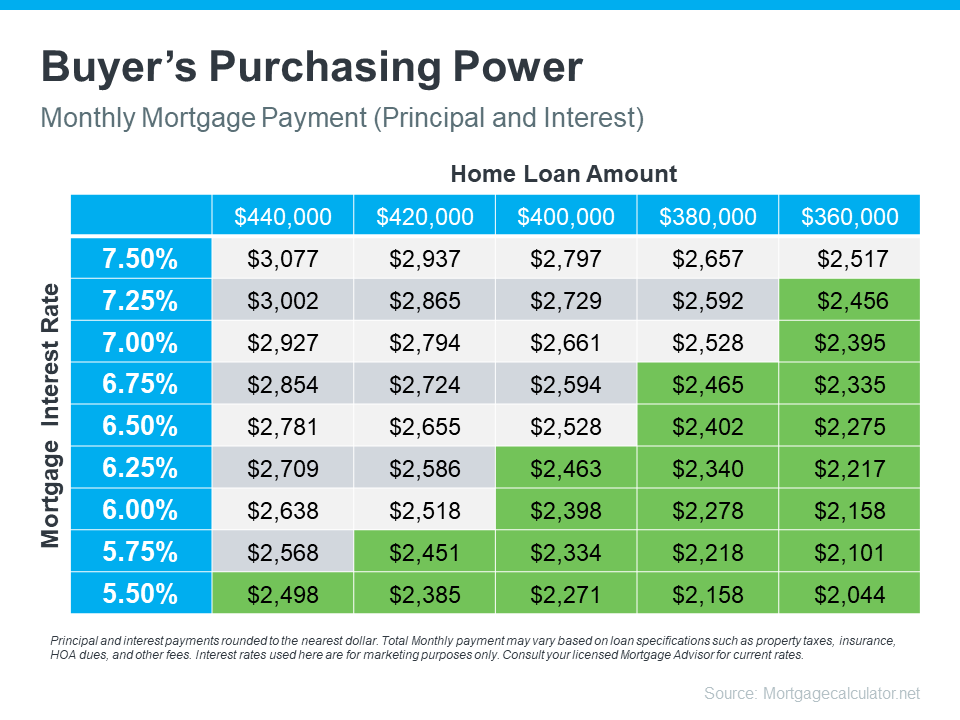

How Mortgage Rates Affect Your Search for a Home

Understanding the connection between mortgage rates and your monthly home payment is crucial for your plans to become a homeowner. The chart below illustrates how your ability to afford a home changes when mortgage rates shift. Imagine your budget allows for a monthly payment between $2,400 and $2,500. The green part in the chart shows payments in that range or lower (see chart below):

As you can see, even small rate changes can affect your budget and the loan amount you can afford.

Get Help from Reliable Experts To Understand Your Budget and Plan Ahead

When buying a home, getting guidance from a local real estate agent and a trusted lender is essential. We can help you explore different mortgage options. In addition to understanding what makes mortgage rates go up or down and how those changes impact you.

By looking at the numbers and the latest data together and adjusting your strategy based on today’s rates, you’ll be better prepared and ready to buy a home.

Key Takeaway

If you’re looking to buy a home, you should know the recent downward trend in mortgage rates is good news for your move. Let’s connect and plan your next steps.

Other educational articles about the market and your home search are under Karen’s Blog. Additionally, explore the search bar for other topics of interest.