There’s been a lot of focus on higher mortgage rates and how they create affordability challenges for today’s homebuyers. Rates have indeed climbed dramatically since the record-low we saw during the pandemic. But home affordability is based on more than just mortgage rates – a combination of mortgage rates, home prices, and wages determines it.

Considering how each of these factors changes gives you the full picture of home affordability today. Here’s the latest.

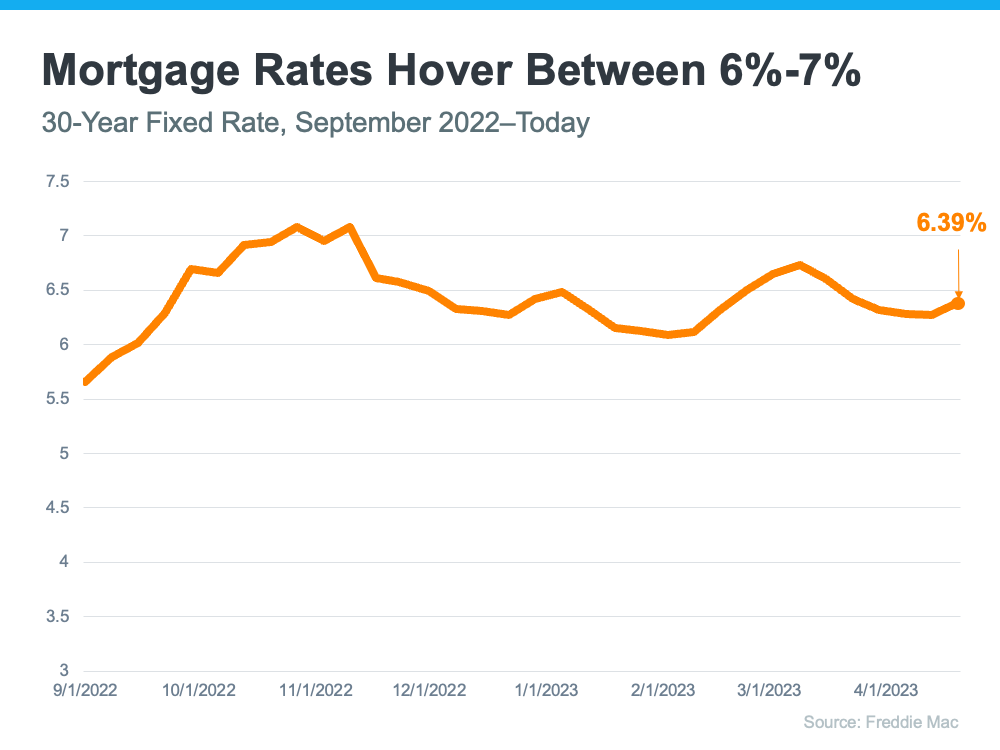

1. Mortgage Rates

While mortgage rates are higher than they were a year ago, they’ve hovered primarily between 6% and 7% for nearly eight months now (see graph below):

As the graph shows, mortgage rates have experienced some volatility during that time. And even a small change in mortgage rates impacts your purchasing power. That’s why it’s so important to lean on your team of real estate professionals for expert advice to stay current on what’s happening in the market. While it’s hard to project where mortgage rates will go from here, many experts agree they’ll likely remain around 6%-7% in the immediate future.

2. Home Prices

Over the past few years, home prices appreciated rapidly as the record-low mortgage rates we saw during the pandemic led to a surge in buyer demand. The heightened buyer demand happened while the supply of homes for sale was at record lows, and that imbalance put upward pressure on home prices. However, today’s higher mortgage rates have slowed down price appreciation.

And the truth is home price appreciation varies by market. Some areas are seeing slight declines, while others have climbing prices. As Selma Hepp, Chief Economist at CoreLogic, explains:

“The divergence in home price changes across the U.S. reflects a tale of two housing markets. Declines in the West are due to the tech industry slowdown and a severe lack of affordability after decades of undersupply. The consistent gains in the Southeast and South reflect strong job markets, in-migration patterns and relative affordability due to new home construction.”

Contact a trusted real estate agent to find out what’s happening with prices in your local market.

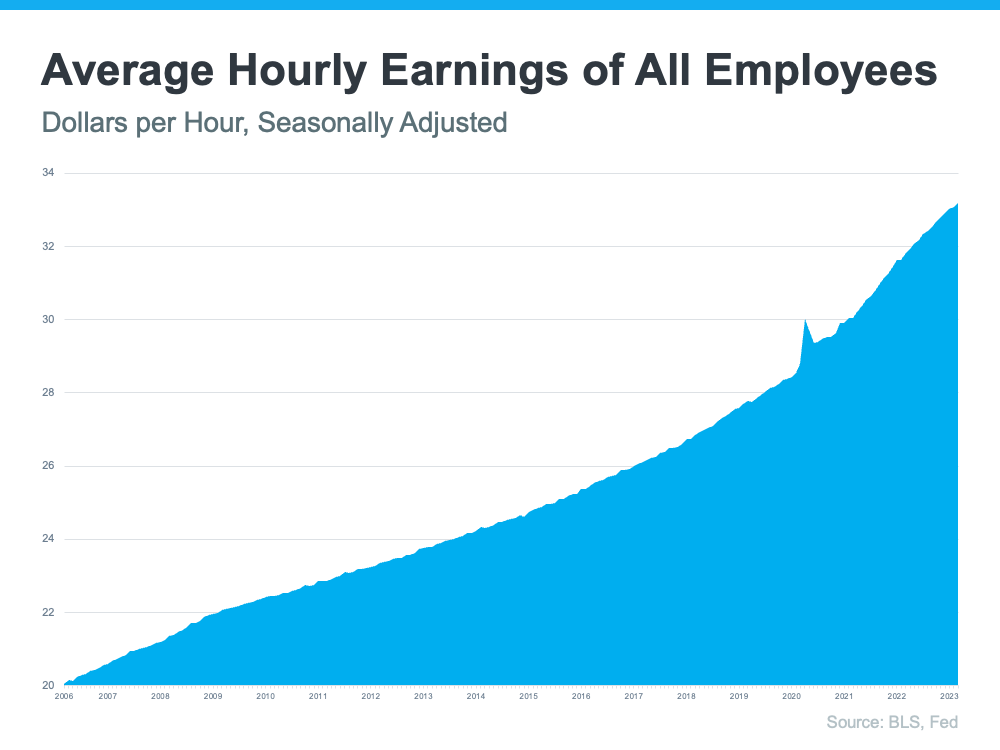

3. Wages

The most positive factor in affordability right now is rising income. The graph below uses data from the Bureau of Labor Statistics (BLS) to show how wages have grown over time:

Higher wages improve affordability by reducing the percentage of your income to pay your mortgage since you don’t have to spend as much of your paycheck on your monthly housing cost.

Home affordability comes down to rates, prices, and wages. If you have questions or want to learn more, contact a real estate professional who can explain what’s happening locally and how these factors work together.

Key Takeaway

If you plan to buy a home, knowing the key factors that impact affordability is essential to make an informed decision. To stay current on the latest on each, let’s connect today.

Other educational articles about the market and your home search are under Karen’s Blog. Additionally, explore the search bar for other topics of interest.

Interesting Reading